2025 Hsa Maximum Contribution Limits. Employer contributions count toward the annual hsa. Here are the changes coming in 2025:

Federal Hsa Limits 2025 Renie Delcine, This additional contribution amount remains unchanged from 2025. Here are the changes coming in 2025:

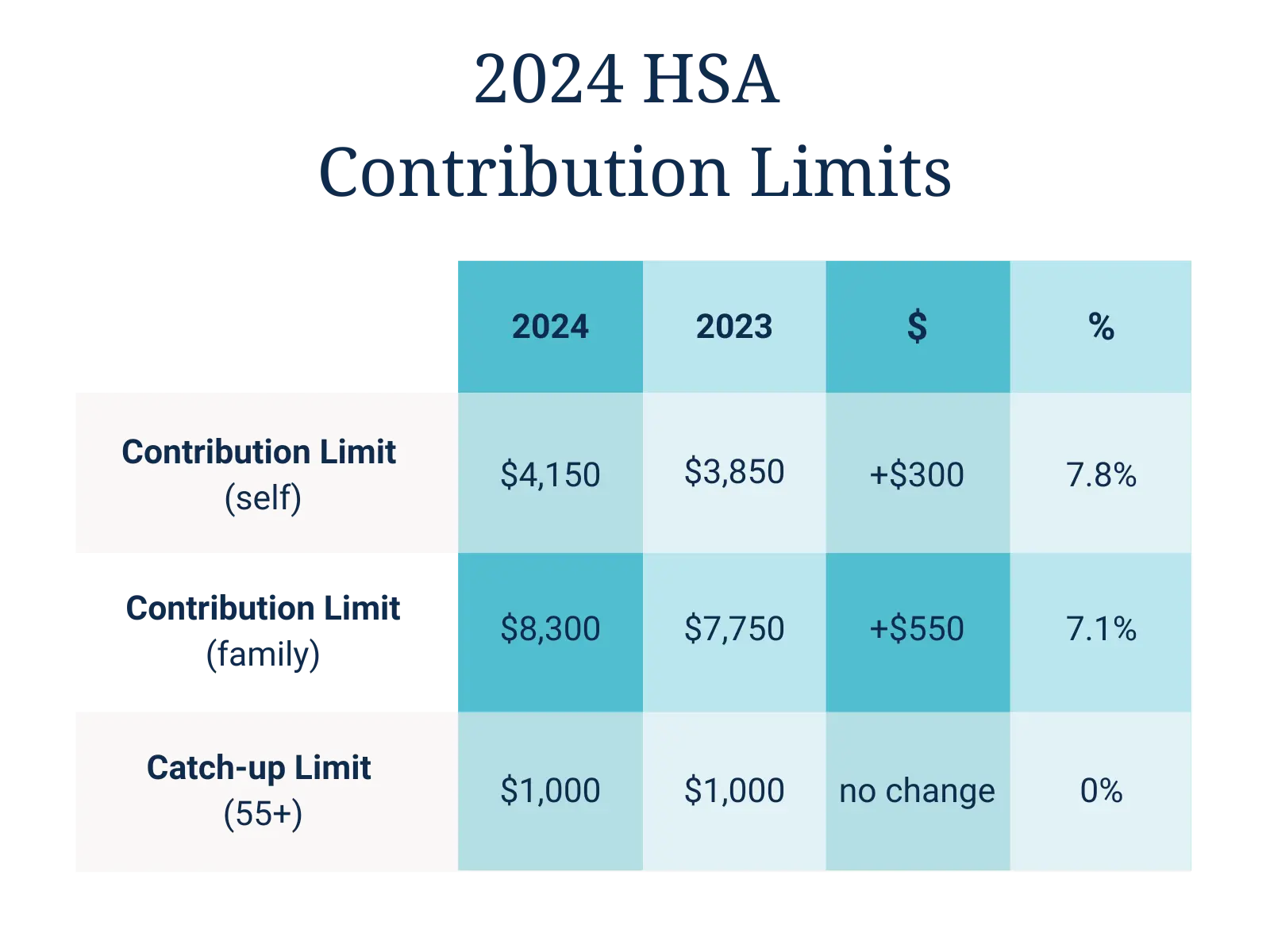

2025 Hsa Family Contribution Limits Layne Myranda, The new 2025 hsa contribution limit is $4,150 if you are single—a 7.8% increase from the maximum contribution limit of $3,850 in 2025. Starting in 2025, the hsa contribution limit for an individual will increase to $4,150, up from the previous limit of $3,850 in 2025.

Significant HSA Contribution Limit Increase for 2025, Individuals who are 55 or older may be able to contribute an additional $1,000 to their hsa in 2025. But in 2025, the benefits will get.

Hsa Contribution Limits For 2025 Eleni Tuesday, Employer contributions count toward the annual hsa. 2025 max hsa contribution limits family.

HSA Contribution Limits And IRS Plan Guidelines, The new 2025 hsa contribution limit is $4,150 if you are single—a 7.8% increase from the maximum contribution limit of $3,850 in 2025. But in 2025, the benefits will get.

Maximum Hsa Contribution 2025 With Catch Up Katee Ethelda, The maximum contribution for family coverage is $8,300. The health savings account (hsa).

Annual Hsa Contribution Limit 2025 Married Filing Ardyce Jerrie, The 2025 hsa contribution limit for individual coverage increases by $300 to $4,150. The irs also made changes to the maximum out.

IRS Makes Historical Increase to 2025 HSA Contribution Limits First, Here are the changes coming in 2025: The maximum contribution for family coverage is $8,300.

RecordHigh 2025 HSA Contribution Limit PPL CPA, Let’s explore the contribution limits for 2025: Your contribution limit increases by $1,000 if you’re 55 or older.

Max Hsa Contribution 2025 Over 50 Gusty Katusha, You must have an eligible. $4,150 ($300 increase) family coverage:

Jumping down to the maximum contribution levels, the roughly seven percent rate increases will boost individual coverage to $4,150 and family coverage to.